Solar energy is an intermittent, renewable source of power that is captured in a variety of ways when the sun is shining. There are several different applications for solar energy; a few examples found in Idaho include: remote-facility electrification, lighting, communications, powering monitoring devices, warning signs, water pumping and cathodic protection. The largest use of solar energy in Idaho is to provide electricity; this is done both at the individual or residential level and utility-scale. Utility-scale solar power generation – or power developed for retail use – in Idaho began in August 2016 and accounts for more than 90% of the solar power generation in the State. In 2022, the total installed solar power generation was 619 MW.[1]

Solar energy is an intermittent, renewable source of power that is captured in a variety of ways when the sun is shining. There are several different applications for solar energy; a few examples found in Idaho include: remote-facility electrification, lighting, communications, powering monitoring devices, warning signs, water pumping and cathodic protection. The largest use of solar energy in Idaho is to provide electricity; this is done both at the individual or residential level and utility-scale. Utility-scale solar power generation – or power developed for retail use – in Idaho began in August 2016 and accounts for more than 90% of the solar power generation in the State. In 2022, the total installed solar power generation was 619 MW.[1] There are a few different technologies used to capture solar energy for consumption. Either photovoltaic (PV) solar cells or concentrated solar power (CSP) can be used to absorb the sun’s energy and produce heat. PV solar cells convert sunlight by using solar plates stationed on an array that is angled towards the sun. CSP technologies concentrate reflected sunlight off of mirrors onto receivers that converts that light into heat that is warming either air or liquid. This process generates energy which is then used to make electricity.

A third use of solar energy is in solar water heating or thermal systems. These systems are generally used to heat buildings by using a series of pumps to transfer heated fluid through pipes in the building. There are two types of water heating systems, active and passive. Active systems circulate liquid, either water or anti-freezing heat-transfer fluid, through a series of pumps and controls located in pipes. Passive systems use the movement of hot water rising and cool water sinking to push water through a pipe system without the use of pumps. Both systems use a storage tank and solar panels to collect the needed heat.

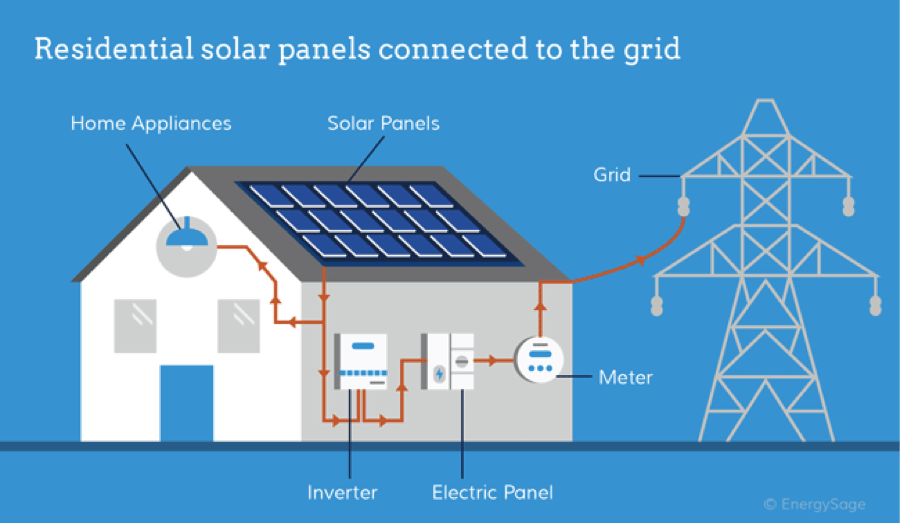

The images below demonstrate an example of each type of system previously described.

MAPS

- To see where Idaho’s solar farms are located, click here.

FINANCING

State Energy Loan Program:

- The Idaho Governor’s Office of Energy and Mineral Resources offers low interest energy loans up to $15,000 to Idaho citizens and up to $100,000 to Idaho businesses who are interested in in installing energy efficient products and developing renewable energy projects within the state.

Federal Renewable Electricity Investment Tax Credit for Solar:

- The federal renewable investment tax credit (ITC) for solar is a tax credit that can be claimed on the federal income taxes of individuals or corporations for a portion of the cost of installing. The ITC is currently a federal tax credit claimed against the tax liability of residential (under Section 25D of the U.S. tax code) and commercial/utility (under Section 48 of the U.S. tax code) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to their personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs and/or finances the project claims the credit.

- The ITC for solar power projects which would have expired in 2020 will now remain at 26% for projects that begin construction in 2021 and 2022, be reduced to 22% in 2023, and decrease to 10% in 2024 for commercial size projects. There will be no credit for small-scale solar by 2024.

CERTIFICATION

If you are looking to get certified as a solar installer, please review these organizations for further information on exams and Idaho specific requirements:

- The North American Board of Certified Energy Practitioners (NABCEP) periodically schedules national solar PV and hot water heater installer certification exams. The website includes an exam study guide. For detailed information regarding qualifications, please visit: https://www.nabcep.org/.

- The Idaho Division of Building Safety (DBS) safeguards the citizens of Idaho through responsible administration of building and construction-related safety and licensure standards while promoting a positive business climate. For detailed information on DBS’ electrical program, which includes solar installation, please contact: https://dbs.idaho.gov/ .

RELATED LINKS

- American Council on Renewable Energy (ACORE)

- American Solar Energy Society (ASES)

- National Renewable Energy Laboratory: Solar Research(NREL)

- NREL’s 2019 Publication: “Up to the Challenge:Communities Deploy Solar in Underserved Markets“

- Smart Electric Power Association (SEPA)

- Solar America Board for Codes and Standards (Solar ABCs)

- Solar Energy Industries Association (SEIA)

- Solar Rating and Certification Corporation (SRCC)

- Glossary of Solar Energy Terms

Official Government Website

Official Government Website